Do You Have Good Acquisition & Retention Price Strategy?

Summary

The best strategy is Acquisition Price < Renewal Price, in other words: “I acquire at low price and I retain at high price”. This strategy helps increase the number of subscribers and average revenue per user while having a limited impact on the Retention Rate.

In this article, I talk about the Acquisition Price and Renewal Price tandem. The freemium model is out of scope.

I want to choose, from all possible Acquisition-Renewal price pairs, the best combination. It will be my price strategy (excluding promotions) and I will communicate it transparently during transactions.

The best pricing strategy helps achieve my objectives on the three macro KPIs of the subscription business*. This price pair influences my ability to acquire new customers, retain existing customers, and it defines the average revenue per subscriber.

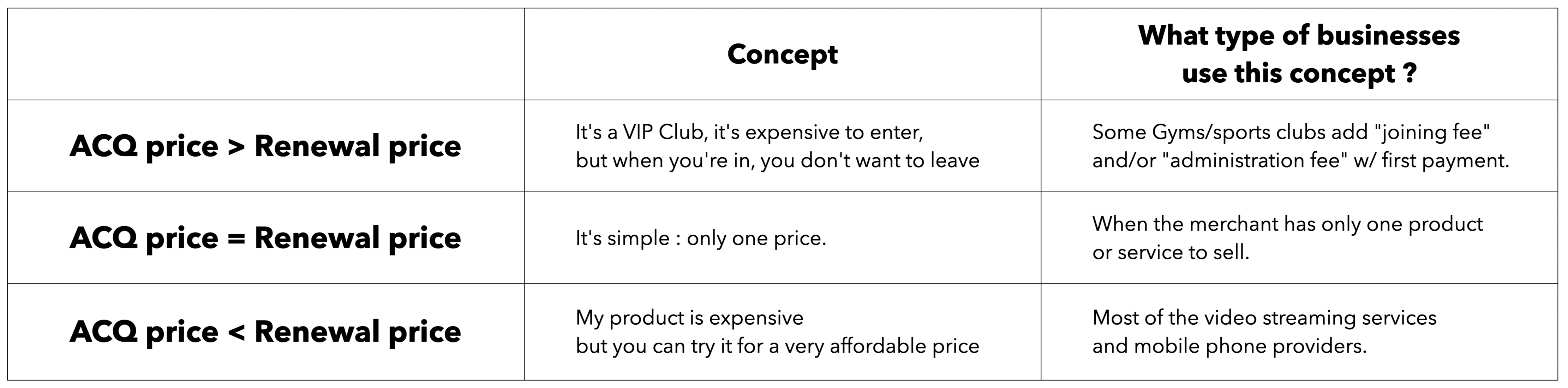

1. The 3 possible pricing strategies.

There are three possible strategies:

- The acquisition price is equal to the renewal price

- The acquisition price is lower than the renewal price

- The acquisition price is higher than the renewal price

In a subscription business, customers must know the renewal price so they can take an informed purchase decision. Each of the three strategies sends a different message to the client and each has an application.

Table #1 : the 3 different concepts

2. The Consequences of the choice of pricing strategy

It’s unlikely to find the perfect Acquisition-Renewal price pair when launching a subscription business. So I should test hypotheses.

If I modify my renewal price upwards or downwards, I impact all of my existing subscribers as I’ll modify my Average Selling Price (ASP), and my Retention Rate (RR%).

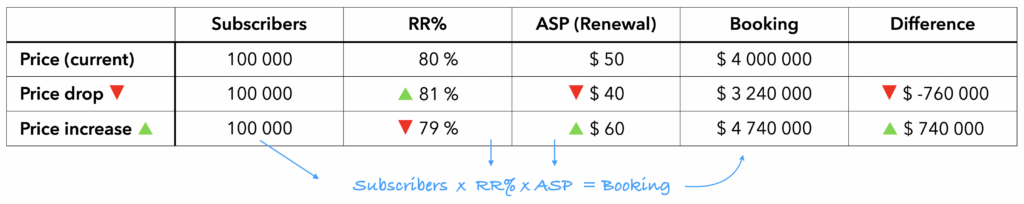

Let’s consider the following example:

I sell accounting software as an annual subscription for $ 50 and my RR% is 80%. My 100,000 subscribers are quite price sensitive. Each variation of $ 10 results in a variation of Retention Rate by 1 point.

Let’s get out the calculators!

Table #2 : Retention price change impact on a large installed base

Results :

- A reduction of €10 in the renewal price will result in a loss of €-760k over the year for a gain of 1% in RR% (i.e. +1000 subscribers retained).

- An increase of €10 in the renewal price will result in a gain of €740k over the year for a loss of 1% of RR% (i.e. -1000 subscribers lost).

As we can see, losses or gains can be significant when a change impacts the entire installed base.

3. What if my business is in the start-up phase

In a phase of customer acquisition, I set my acquisition price based on my costs and the market; I can’t afford to change it yet. So, I only consider variations in my renewal price and the acquisition will be minimally impacted.

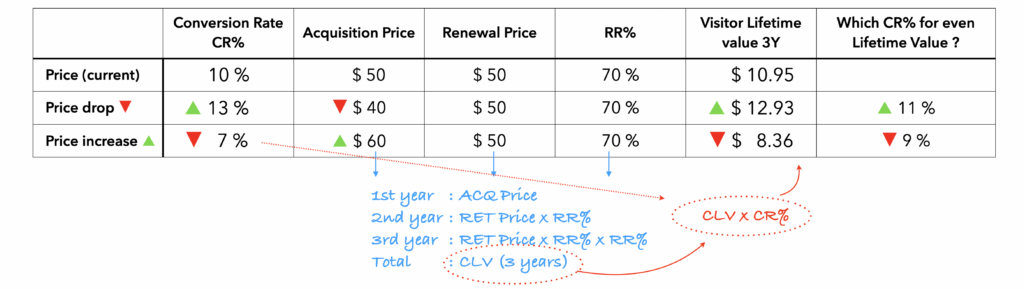

Let’s consider the following example:

My reference pair is $ 50-$ 50; I assume my clients have a sensitivity of 1 point of RR% per increment of $ 10. I calculate the Customer Lifetime Value (CLV) of each option. In addition, I calculate the Retention Rate (RR%) that would be necessary to keep CLV even.

Table #3 : CLV impact according to Retention price change

Results :

- Renewal price is down: I gain 1 point of RR% but I lose $ 11 of CLV. To maintain the same CLV, an increase of 12 points in RR% would be required.

- Renewal price is up: I lose 1 point of RR% but I gain $ 10 of CLV. To keep the same CLV, I can afford a loss of 8 points of RR%

Under these conditions, the Acquisition Price < Renewal Price strategy is the most profitable and the most achievable.

4. What if my business is mature

As my business is mature, my installed base is large. I want little to no impact on my retention business, so I choose to vary the Acquisition price. There will be a direct impact on the number of acquired subscribers. My calculations must reflect this parameter. I’ll calculate : Lifetime Value per visitor = CLV x CR%

Let’s take the example again:

My reference pair is $ 50-$ 50; I assume my clients have a sensitivity of 1 point of RR% per increment of $ 10. I calculate the Customer Lifetime Value (CLV) of each option. In addition, I calculate the Retention Rate (RR%) that would be necessary to keep CLV even.

Table #4 : Visitor Lifetime value impact according to Acquisition price change

Results :

- We can compensate for variations in the acquisition price by an opposite variation in the conversion rate. I obtain a better return per visitor (per prospect) with the ACQ Price < Renewal Price strategy.

Key Takeaways

- The acquisition price is paid once💰, the renewal price several times💰💰💰; this is why the Retention price has an interest in being as high as possible.

- The Acquisition Price < Renewal Price strategy is the winning strategy in most cases.

- In the long term, it’s always better to push for subscriber acquisition. This is what the Acquisition Price < Renewal Price strategy achieves better than others.

* The three macro KPIs are : Number of Customers, Retention Rate and Average Revenue Per User