Monthly or Yearly Paiement? Which is best?

Summary

Paying your subscription once a year is better for both customer and merchant. For the customer, it’s usually cheaper. For the merchant, the retention rate is usually higher and there are less transaction fees.

Disclaimer: I will exclude from the discussion subscriptions with price depending on usage, such as mobile phone subscriptions. This article only applies to fixed price subscriptions for individual consumers using usual payment methods (credit/debit card, PayPal, Direct Debit etc…)

Some subscriptions are initially offered with recurring monthly payment, others are offered with annual payment. Sometimes both options are offered.

1. What is the supposed benefit of the monthly payment?

From customer stand point:

- It gives a feeling of affordability,

- It gives an impression of freedom (absence of commitment).

From merchant stand point:

- It sounds easier to charge a small amount 12 times rather than a large amount once.

2. What is the reality of the monthly payment?

The annualized monthly price is generally 20% more expensive than the annual price since the monthly payments are equal to one 10th of the annual price. For example, € 100 /year will translate into € 10 /month.

Monthly isn’t cheaper, prices are presented this way mainly for an aesthetic reason: €5.99 /month or €59.99/year.

The commitment depends on the merchant’s terms and conditions to which the customer agrees to at time of purchase. In EU and UK, the merchant can decide that the initial commitment is 1 year even if the payment is monthly; only after the initial commitment has expired can the subscription be canceled at any time.

Monthly doesn’t rhyme with “no commitment”.

Now, let’s review the ease of charge.

First of all, there’s a higher potential risk with monthly payments for technical reasons: in case the payment gateway would be unavailable for a day, for instance, there’s a risk on one 30th of my monthly subscriptions but only one 365th of my yearly subscriptions. Any bug in the subscription management system should affect less annual subscriptions.

Second, the likelihood of charging a customer doesn’t depend only on the presence of money 💵 in the bank account but on multiple factors such as:

- The reputation of the merchant and his legitimacy to initiate a payment,

- Recurring payment history,

- The quality of the payment method details (billing details being up-to-date),…

Next, the billing window: when a payment request is rejected, the merchant will make several additional billing attempts. The billing window is the time between the first attempt and the last possible attempt.

When billing monthly, the billing window is only a few days.

When billing annually, the window can be several weeks: statistically, it’s more likely to charge successfully over 3 weeks than over 3 days.

Finally, there’s more chance to charge 1 time € 120 than 12 times € 10 for mathematical reasons.

Not convinced yet?

3. Comparing monthly or annual payment based on a case study

Let’s take a simple example to compare annual and monthly renewal works:

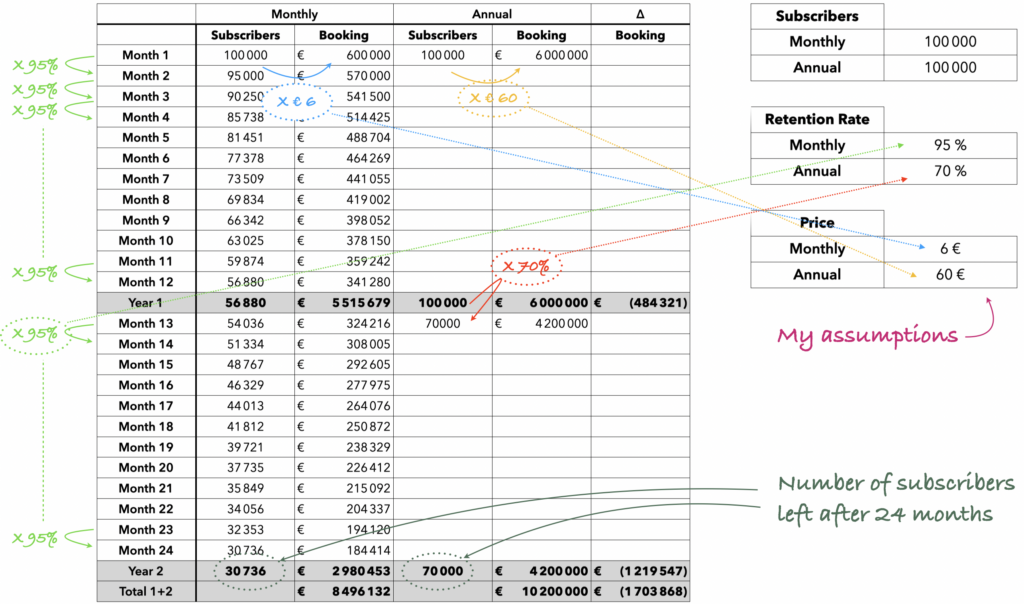

I run a video streaming service for € 5.99 /mo or € 59.99 /yr and I acquire:

- a batch of 100,000 subscribers on a monthly payment retaining at 95% for € 6 /month.

- another batch of 100,000 subscribers on an annual plan retaining at 70% for € 60 /year.

- Acquisition happens on month #1, the monthly retention rate only applies from the month #2 onwards.

- Annual retention happens on month #13.

Note: 95% (Monthly) and 70% (Annual) are realistic and pretty good retentions rate. Retention Rates always evolve over time but I took a fixed value to keep the business case simple.

Table #1: comparison of a batch of 100k monthly subscriptions and 100k annual subscriptions over 2 years

In the table above, I observe my number of subscribers and my booking for 2 samples of equal size:

- Year 1 total: Monthly batch ends with a negative difference of -€ 484 k

- Year 2 total: Monthly batch ends with a negative difference of -€ 1.2 M

- After 2 years, I kept 30% of my initial monthly subscribers against 70% of my annual ones.

👉Monthly billing requires an uninterrupted series of successes: the 4th billing implies the success of the 3rd and 2nd. As a consequence, in mathematical words, it means…

👉The annualized retention rate is equal to my RR% to the power of 12.

If my monthly RR% is 95%, my annualized rate is 95% x 95% x …(12 times) = 54%

Key takeaways:

- As a customer, I prefer the annual subscription because it is cheaper over a year. If I can’t afford the annual price, I shouldn’t subscribe in first place.

- As a merchant, I prefer the annual subscription for 2 reasons: 1️⃣ My annualized retention rate will be better, and 2️⃣ My billing window being wider, I have more time for charging successfully and for planning recovery actions for customers at risk.

- If I acquire most of my customers on monthly billing, because of market dynamics then, I should encourage them to change for an annual billing as soon as possible in the lifecycle.